Ambulance & (EMS) Emergency Vehicle Financing

Comprehensive Ambulance Financing Solutions | Flexible Terms & Competitive Rates

Explore our comprehensive ambulance financing solutions. Get flexible terms and competitive rates for used and new ambulances, patient transport vehicles, medical transport vans, and more. Contact us to discuss your ambulance financing needs.

Comprehensive Ambulance Financing Solutions

Commercial Fleet Financing offers comprehensive ambulance financing solutions to help you acquire the vehicles and equipment you need. Whether you are looking for used or new ambulances, patient transport vehicles, or medical transport vans, our flexible financing options can assist you in making your purchase. We specialize in providing ambulance financing with competitive rates and flexible terms to suit your budget.

Our ambulance financing solutions cover a wide range of needs, including ambulance leasing, emergency vehicle financing, and financing for specialized equipment. Whether you are an EMS (Emergency Medical Services) organization, a medical transportation service, or an individual looking to invest in an ambulance, we have the expertise to structure financing that meets your requirements.

Simplified Ambulance Financing Process

At Commercial Fleet Financing, we understand that financing can be a complex process. That is why we have streamlined our application and approval process to make it as efficient as possible. Our dedicated team will guide you through the entire financing journey, ensuring a smooth and hassle-free experience.

We provide financing solutions tailored to your unique needs. Whether you are looking to lease an ambulance, purchase patient transport vehicles, or acquire medical transport vans with wheelchair access, our flexible financing options can help. We consider several factors beyond credit scores to ensure you receive the best financing terms possible.

Start Your Ambulance Financing Journey Today

Ready to explore our comprehensive ambulance financing solutions? Contact Commercial Fleet Financing to discuss your specific needs. Our team of experts will work with you to create a customized financing plan that aligns with your budget and goals. Contact us today to take the first step toward acquiring the necessary vehicles and equipment.

Ambulance Brands We Finance

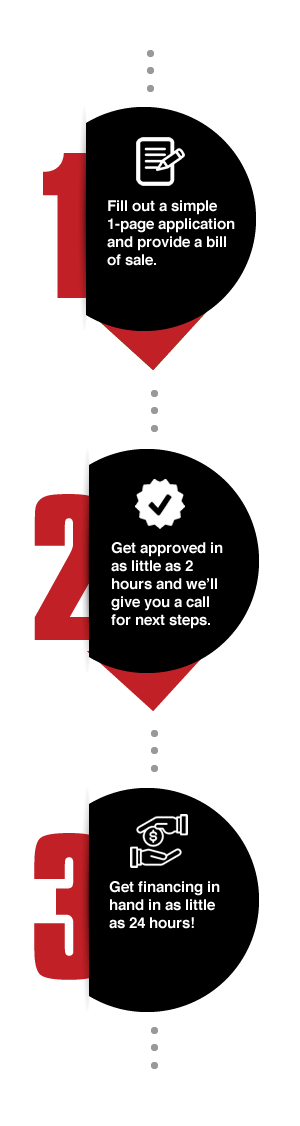

The CFF Process is Easy as 1-2-3!

The CFF Advantage is Clear

Testimonials

Low down payment, fast approval, decent interest rates.

5 Star Rating

My sales rep was very knowledgeable and on top of things throughout the process. So, we did 2 deals and both went very smoothly with no issues, because he was straight forward and easy to work with.

5 Star Rating.

My loan consultant was very professional and I felt really good after taking with him that CFF was a company I wanted to do business with.

5 Star Rating.

I have purchased several automobiles in the past and will purchase lots more, by far this has been the best experience thus far. I have already referred a few clients to CFF and will continue to do so.

5 Star Rating.

FAQs

Fast Credit Approvals and Funds in as little as 24 Hours

At CFF, we are experts in the AMBULANCE INDUSTRY. Since 1995, we have financed thousands of all types of vehicles and equipment:

• Type I, II and III ambulances

• Handicap vans and shuttles

• Medical equipment

• Stretchers

• Defibrillators

• And much more!

CFF is one of the largest independent financing companies for the purchase or leasing of all makes, models, and sizes of ambulances. Whether you lease or purchase your rig, we create a finance package to meet your individual requirements and circumstances. CFF has a No-Age-Restriction Financing Program for Ambulances. In some cases, older equipment can generate the same income as new equipment with a substantially lower payment. At CFF, we understand this. Regardless of the the age of the equipment, CFF can finance it for you. Our program is unique and allows you to buy equipment that fits your needs.

Download – THE 5-STEP COMMERCIAL TRUCK FINANCE PROCESS EBOOK

We will take a detailed look into the funding process, including equipment we finance, pre-approvals, and discussing terms and loan amounts.